Make It Home: A plan to support homeownership, stabilize east side CLE neighborhoods

In early April, a group of five local organizations and the City of Cleveland came together with Detroit-based Rocket Community Fund to announce a new program to help improve housing and stabilization in Cleveland’s east side neighborhoods, preventing the displacement of renters, and creating homeownership opportunities for residents in neighborhoods with the highest number of the tax delinquent properties and where Black homeownership rates are disproportionately low.

Enterprise Community Partners (Enterprise), the City of Cleveland, Cuyahoga Land Bank, CHN Housing Partners, Legal Aid Society of Cleveland, and the Northeast Ohio Coalition for the Homeless (NEOCH) are working together with Rocket Community Fund to use $1.5 million in ARPA money to launch the Make It Home Cleveland program—a program first started in 2017 in Detroit by Rocket Community Fund.

The groups partnering are optimistic that Make It Home Cleveland can help reverse the trajectory of some of Cleveland’s most underserved neighborhoods.

The Clark-Fulton neighborhood home after completion with funding from a land bank program“Participating in this impactful, nationwide program with mission-aligned partners not only allows us to gain knowledge and insight of best practices, but, more importantly, further increases the opportunity for homeownership in Cuyahoga County,” says Ricardo Leon, COO of the Cuyahoga Land Bank. “Home ownership is a key component of the Land Bank’s mission in helping stabilize neighborhoods and invest in communities. We look forward to continued collaboration and are excited for what lies ahead.”

The Make It Home program will allow about 50 residents living in tax forfeited properties to purchase and repair their homes. Ayonna Blue Donald, vice president of Enterprise’s Ohio market, says there are a varying number of about 160 tax-forfeited homes that are currently occupied by renters.

When a home is in tax foreclosure, Blue Donald says the property owner hasn’t paid the property taxes and the county forecloses on the property. She says there are about 160 such properties in Cleveland—the majority of which are in Cleveland’s East Side neighborhoods.

“The tax forfeited properties have been put up for sale a couple of times, but no one has bought them,” explains Blue Donald. “So, essentially, they're in this quasi-ownership stage where they're forfeited to the state. The state will say that it doesn’t own them, and then the previous owner will also technically not own the property. So, this quasi state allows the County Land Bank to acquire those properties, clear the liens on them, and transfer those properties for a low minimum cost.”

Potential candidates for the program will be identified and selected by NEOCH. CHN and the Legal Aid Society will then work with each homeowner to provide housing counseling and support them to achieve sustainable homeownership, while Cuyahoga Land Bank, which inspects and markets tax forfeited properties for productive reuse, will help residents acquire their homes for minimal price.

Make it Home overview“We will and go to those properties and see who's interested,” says Blue Donald. “After we see who may be interested in the program, they will go through a financial counseling or homeownership counseling program to make sure that they're ready to actually become homeowners. We want to set people up for success—to be long term property owners.”

Make it Home overview“We will and go to those properties and see who's interested,” says Blue Donald. “After we see who may be interested in the program, they will go through a financial counseling or homeownership counseling program to make sure that they're ready to actually become homeowners. We want to set people up for success—to be long term property owners.”

Once the potential homeowners have been identified and qualify for the home, the property will be assessed for needed repairs and how much funding the new owner is eligible to receive.

“The property will be transferred to that occupant to make them the homeowner,” Blue Donald explains. “As they're going through counseling, there will be an assessment of that property to determine what the scope of work or repairs may have to be done. Then the ARPA dollars that we are leveraging people will be eligible for, depending on what bucket of funding that comes from, either grants, forgivable loans, or low-interest or no-interest loans, to actually undertake repairs on their home.

“Legal Aid Society will undertake the mission of doing survivorship deeds for these properties, to make sure that we're creating a pathway for upward mobility and generational wealth,” she continues. “Because we’ve all seen properties that sit and become vacant in the city of Cleveland, because maybe someone dies, and it doesn't go through probate. So we're trying to address that issue right from the very beginning.

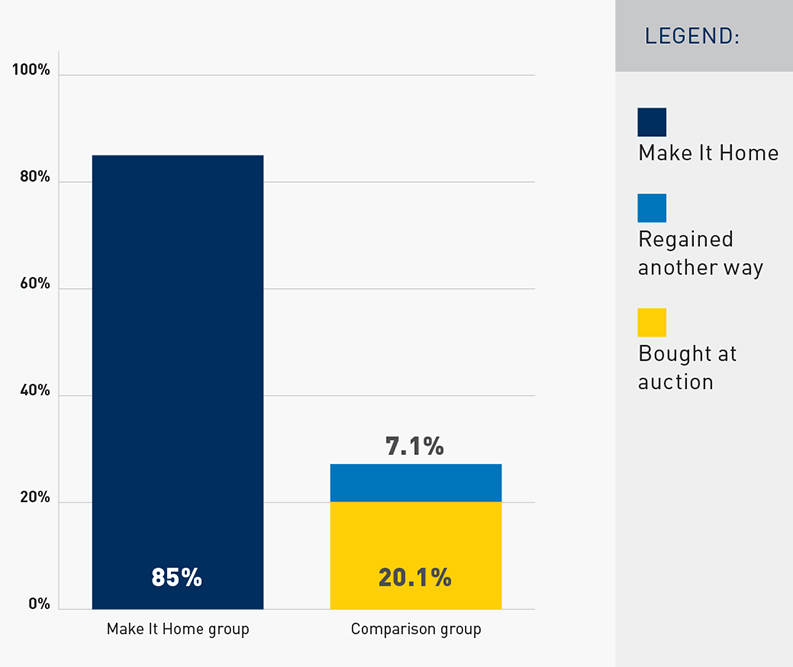

Percent of Detroit participants who purchased their houses within the first yearThe Make It Home program was first created by the Rocket Community Fund in 2017 to help eligible Detroit families at risk of tax foreclosure avoid displacement. Instead of losing the home to the tax auction, renters and other eligible residents are offered the first right to purchase their property for an average of $10,000. The program has created 1,500 new Detroit homeowners and Rocket Community Fund decided to expand the programs to other cities.

Percent of Detroit participants who purchased their houses within the first yearThe Make It Home program was first created by the Rocket Community Fund in 2017 to help eligible Detroit families at risk of tax foreclosure avoid displacement. Instead of losing the home to the tax auction, renters and other eligible residents are offered the first right to purchase their property for an average of $10,000. The program has created 1,500 new Detroit homeowners and Rocket Community Fund decided to expand the programs to other cities.

"They conducted a study that investigated what cities would be good cities to expand this program to, and thankfully, Cleveland was one of them,” says Blue Donald. “Rocket Community Fund had already had initial conversations with the City of Cleveland and Cuyahoga Land bank, and they approached Enterprise Community Partners to say, ‘hey, would you be interested in think tanking this program?’”

In addition to funding from the Rocket Community Fund, the program will be supported by Cleveland’s ARPA funds, which includes a previous allocation to CHN.

Residents living in tax forfeited properties who are not interested or eligible for the program will receive housing stability services like relocation or legal assistance.

The program is expected to fully launch later this spring, says Blue Donald. In the meantime, Enterprise is leading the search for a senior program officer with Make It Home Cleveland.